Triveni Engineering: A value buy

IntroductionWhen the sensex is at 14,000 normally it should be very difficult to invest in the market if some one follows the conventional wisdom. But this time it is very different. It seems even now many stocks can be found in the market where there is valuation comfort and in some cases undervaluation. I guess mainly it is due to the fact that in the recent sensex rise only a handful of stocks participated and the pocket of over valuation is limited to very few stocks and sectors. For example the real estate and construction sector which is the favorite sector and where you can find most over valuation.

You can access my article on the over valuation of real estate sector here

"Real Estate Reality Check"One such stock which is in a neglected sector and which is one of the major player in its sector is Triveni Engineering. This trades at a price of 55Rs and a Market Cap of 1400Cr.

You can read the complete analysis of this stock and the sector given below.

Key Investment HighlightsSugar Business•Second largest producers of Sugar in India with a crushing capacity of 40,500 TCD per year (2005-06)

•The company is undergoing a massive expansion plan where the capacity will be increased to 61,000 TCD by Feb 07.

•The company will also commission a 160 KLPD ethanol manufacturing plant by March07

•The Co-Gen capacity will be increased from the current 22MW to 68MW by 2007 which will also create 2,00,000 carbon credits

Steam Turbine Business (TBG – Turbine Business Group)

•One of the largest manufacturers of 1-12 MW steam turbines in the world with a 68% market share in India’s high and low pressure turbines up to 18 MW.

•Manufacturing capacity of 650MW in turbines which is being expanded to 1100MW in 2006-07 (Fourth Qtr)

•More than 1800 turbine installations.

•Order book of 512Cr as of Sep2006 for Turbine Business Group (TBG)

•Turbine Business Group's revenues is now close to 47% of the group's total revenues up from 22% just two Qtr ago making it a second line of business apart from sugar.

•Exponential growth seen in turbine business with industrial growth.

•The company is also getting in to higher MW turbine business (18-45MW) whose market is almost 50% bigger than the up to 18MW segment.

•TBG expects a sales of more than 500Cr in FY07 (230Cr already done by half year with a 45% QoQ growth)

•The company is now focusing on exports to Europe and Asia to drive up sales and margins.

Gear Business (GBG – Gear Business Group)•Market leader in high speed gears and gearboxes up to 70MW capacity and 50,000 rpm

•Order book of close to 40Cr as of Sep2006 and expects revenue of 80Cr this year.

•More than 4000 high speed gear box installations in the country.

•This is the first company in India to successfully conduct full speed test on 54 MW gas turbine load gearbox.

Others•The company has already decided to spin off the TBG and GBG to a separate company which will create shareholder value.

•This is one of very few companies that can greatly leverage their stock value for growth as the management holds close to 70% stake and public holding is just under 8%.

•Current market cap of 1400Cr does not even reflect the valuation of sugar business after enhanced capacity.

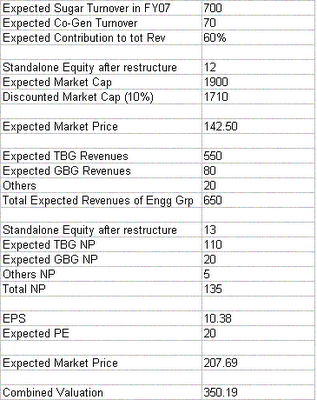

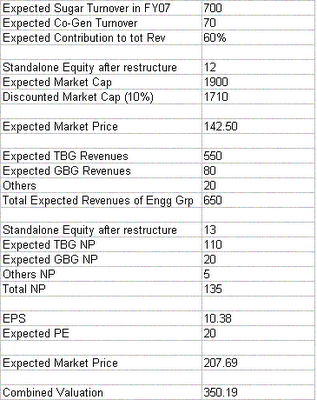

•In my calculation after the spin-off the combined value of business should be around 350 Rs ( Valuation details given later in discussion)

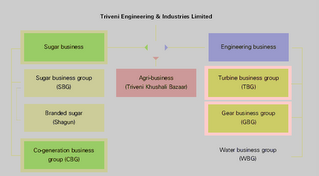

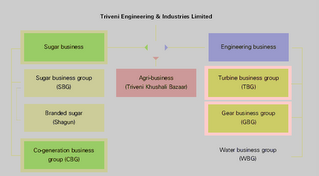

OverviewFirst of all Triveni is not just a sugar company (popular perception is that). Triveni is one of the leading companies engaged in the manufacture of sugar and engineered-to-order

mechanical equipment, such as steam turbines, high speed gears and water and waste water treatment equipment. The company is the second largest sugar manufacturer in India and the market leader in the engineering businesses comprising steam turbines, high speed gears, gearboxes, and water treatment solutions.

Besides this the company also diversified in to futuristic businesses like water and waste-water treatment and rural retail.

The business of the company is best described in the figure below.

The recent downturn in sugar prices has resulted in the downturn of Triveni’s stock price which after touching an all time high of close to 180 is hovering in the range of 55Rs. This is more or less because Triveni is more considered as a Sugar company but the reality is that only 55% of the revenues come from sugar. Also even in sugar business the company is expanding its capacity by almost 50% compared to last year.

Because of all these factors I think this is a good stock if you are willing to hold it for some time. I think Triveni is a good contrarian buy at this level.

To understand why Triveni is a good buy at these levels it is very important to know what are the business the company operates. The highlights of each of these divisions are discussed below.

The Sugar Business Group (SBG)The SBG comprises of the sugar division and the Co-Generation division. My discussion will not cover the outlook for sugar as I am not an expert in commodity cycle. But from my understanding the sugar prices is directly proportional to crude price internationally as when crude rises more sugar cane will get converted to Ethanol. (Ok let’s leave that part).

The company currently has a capacity of 41,000TCD and is being expanded to 61,000 TCD. All these expansion will fall under the UP sugar mill policy where the company will be able to get special incentives in the form of capital subsidy, reimbursement of sugar transportation costs, refund of cane society commission from the government. (Refer UP Sugar Policy 2005-06 for more details)

Apart from the sugar business the company has a Co-Generation business which supplies power to the grid and addresses the captive power and steam requirements of the sugar factory. The Co-Gen division recorded revenue of 60Cr in 2005-06. The company is also

expanding the capacity of Co-Gen plants which will fetch additional revenues in future. Apart from a ready market like a power starved Utter Pradesh the company will also be eligible under the Clean Development Mechanism (CDM), entitling the company to carbon credits, by selling certified emission reductions (CERs). The expected number of carbon credits which is expected after full expansion is around 2, 00,000 numbers. (The company should get approval by Dec-2006)

The Ethanol storyBy Feb-07 the company will also setup a 160 kilolitres per day (KLPD) distillery for the production of rectified spirit, Extra Neutral Alcohol (ENA), absolute alcohol (fuel ethanol) and industrial alcohol.

Now understanding the whole Ethanol story is very important so that you understand the full potential of Triveni going forward. Infact this is same for all sugar companies in India which has Ethanol manufacturing capacity.

Now first let us look at the global scenario. In Brazil and USA Ethanol is produced from sugar cane and maze. So when the prices of crude increases there is an increased temptation to convert more sugarcane to Ethanol thus pushing up Sugar prices (since most of the sugar cane is converted to ethanol). So for sugar companies in Brazil and US it is an alternative product from the same raw material.

But in India situation is different. In India Ethanol is produced from molasses a sugar by-product. So in India the production of ethanol will complement the fortunes of the sugar industry. Coupled with this if government makes mandatory 5% ethanol blend on an all India basis it is just another bonanza for the sugar industry. So the companies with this capacity will definitely benefit and triveni is one among that.

The Turbine Business Group (TBG)Initially the TBG was created as a backward integration of the company’s sugar business but has exceeded all expectations and grown in to an altogether parallel business. Triveni is one of the largest manufacturers of 1-12 MW steam turbines in the world with a 68% market share in India’s high and low pressure turbines upto 18 MW.

This is one group which is growing exponentially on a YoY and a QoQ basis.

So as shown in the charts the TBG group now contributes 47% of the revenues and has the highest visibility in terms of order book. The company is almost doubling the TBG capacity to meet the growing demand.

Another lucrative area the group focuses is the after sales service. The spare business generally generates incremental revenues only after 2-3 years of turbine installation. The recent ramp up in turbine sales will generate substantial incremental spares business in the next few years. The company has 13 service centers across India offering emergency support, routine repair service and spare parts to customers. Because of their pan India presence the company will able to attend any service calls with in 24 hrs which is very important. I expect this area will contribute close to 5-6% of sales in next 2 years.

The company is also getting in to higher MW turbine business (18-45MW) whose market is almost 50% bigger than the up to 18MW segment. TBG expects a sales of more than 500Cr in FY07 (230Cr already done by half year with a 45% QoQ growth).The company is now focusing on exports to Europe and Asia to drive up sales and margins.

The Gear Business Group (GBG)The company started to manufacture gears and gear boxes to the turbine business group. Since then this group emerged as a stand alone business supplying high speed gears and gear boxes to Triveni TBG and also to other prominent OEM’s like Siemens and BHEL.

Another interesting fact is that these OEM’s which are the customers of GBG completes with Triveni’s TBG for the manufacture of steam turbines.

This is another business which have lot of visibility going forward

Sales at this division are expected to be in the range of 80cr this year.

Recently company has successfully conducted full speed test on 54 MW gas turbine load gearbox, at its modern facility in Mysore. It is the highest power gearbox manufactured and tested successfully by any Indian engineering company. It will serve as a replacement to a European Gearbox. This marked the company’s entry in to high MW gear box market.

Other Emerging BusinessApart from these main business above the company has presence in water and waste water treatment solutions and rural retail. Both of these business are currently small in nature but has high potential going forward.

In rural retail the company has a presence with Triveni Kushali Bazaar which will have close to 90 stores by next year. This is a business which has great potential going forward. In 2005-06 the division has a top line of close to 16Cr and is growing exponentially.

De merging to create share holder valueThe board of directors is already considering a proposal to de merge the Engineering business in to a separate entity to create share holder value. This will allow the investors to value each business in a separate way and in the process create wealth for shareholders.

I have created a small valuation matrix which will allow you to calculate the valuation of each of these businesses after the de merger.

NB: This is very premature valuation and can drastically change based on the management decision.

Also if the sugar cycle turns there can be more valuation to the sugar business. And the revenue from 160KLPD Ethanol division and the revenue from possible carbon credits are not considered for calculation. This can further enhance the valuation of sugar business.

That value of 350+ is a huge upside from the current levels. But this is subjected to lots of factors.

RisksThere is risk in investing at the current time. The factor is that sugar is a neglected sector now and Triveni is now perceived more as a sugar company. So any down turn in the sugar prices can adversely affect the company’s valuation.

ConclusionEven though there are some risks in investing in the company at the current levels, I personally feel that it is worth taking a risk especially if you are a long term investor.

Read about other value buys

Geodesic Information: Emerging oppertunity in communication and mobile entertainmentAftek Limited : A stock for the futureDisclaimerAuthor is a software technical consultant based out of Hyderabad. At the time of writing this article he and his family members do have investments in the stock mentioned above. The author, his firm or any of his dependent family members may make purchases or sale of the securities mentioned in the report while the report is in circulation. This report has been prepared solely for information purposes and the information contained herein may not be deemed to be an investment advice. Such information is impersonal and not tailored to the investment needs of any specific person. The information contained herein is not a complete analysis of every material fact representing any company, industry or security. The views expressed may change. While the information contained herein has been obtained from sources believed to

be reliable, no responsibility (or liability) is accepted for the accuracy of its contents. Investors are advised to satisfy themselves before making any investments and should consult with and rely upon their own advisors whether and how to use such information in making any investment decision. Neither the author nor his firm accepts any liability arising out of use of the above information/ article.

Real estate stocks reality check

There are different ways to value a company or a sector, whether it is a sunrise sector or a booming sector. And it definitely applies to real estate stocks. Now there is a fundamental principle in valuing any company it is the future potential earnings. No matter what sector the company operates it is this future earnings potential that drives the stock price.

And most of the times it is just common sense. Infact in my view point real estate sector is the easiest sector to value provided we have sufficient details.

This discussion is not about the future prospects of Indian reality sector (as it is more complex topic due to the diversity of the Indian market) but more about the listed stocks in Indian exchanges.

How to value a real estate company?As I said earlier it is very easy to value a real estate company but provided all the relevant data is there and believe me not many data is required for that. But the problem is that the management of many real estate companies purposefully doesn’t give those simple details which forces the people to value the company based on the available data

So what about valuing a real estate company based on land bank?That is the most popular way to value a real estate company. But the popularity is more in real estate company management and real estate consultant. This is because they can put astonishing value to a stock based on the land bank and cash in on the boom.

Now let us see what is the danger in valuing a company based on land bank. Basically for a real estate company land is a raw material. Now it is up to the company how they want to convert these raw materials in to attractive end products. Land is just like a raw material to real estate company as techie people to a software company or copper mines or zinc mines to sterlite. You don’t value a sterlite or a tata steel for the raw materials they own in terms of inventory or mines but rather you value them based on their capacity and efficiency of production.

Same is the case with a software company also. You don’t value an Infosys or wipro based on the number of people they have but their order book , ability to scale and efficiency to deliver on time. Just think if Reliance or ONGC were valued based on the crude oil reserves they own in their wells the share price of Reliance or ONGC should have touched 1,00000 (yes one lack) by now. This is because oil in well is just oil in well and will not have any impact for the company or shareholders unless you process it sell in the market. And there are many uncertain factors some are more to do with the company and some are to do with the environment in which the company operates in. I bet you that if tomorrow Reliance come out and say that they will refine all the oil in their wells in just one month I am sure the company’s stock price will touch the figure I have mentioned above. But in reality it cannot happen due to some external and internal factors.

So why only value real estate companies based on land bank?. Now that’s a question that investors who invest in these companies need to ask themselves. Real estate company valuations are touching absurd levels and many are trading at a ridiculous multiples of their entire land bank. No one thinks that there is an effort required in terms of scale and money to convert those raw materials in to meaningful assets and it requires more thought and creativity from the management to make this in to an attractive end product.

Now that last sentence is really important. The current trend among real estate companies is that to build a residential project or a retail mall or an IT park (or an SEZ) . Common man are you going to convert all your raw materials in to similar products. Then by the time it completes it is going to be a disaster.

Another important factor is the scale. How the company is aiming to scale their operations so that the company can generate more revenues going forward. Belive me even if the company has a huge land bank it will not generate revenues for the shareholder unless the company is able to scale. And not even 5% of the management of the listed real estate space has the expertise and equipments to scale up their operation to justify these valuations going forward.

I will give you some examples. The data will not give false indications.

Lets take the case of some prominent real estate stocks

Mahindra Gesco.The company has a market cap of 3700Cr. But look at the quarterly numbers.

Details below

|

Sep '05 |

Dec '05 |

Mar '06 |

Jun '06 |

Sep '06 |

Sales Turnover |

22.95 |

31.14 |

42.44 |

34.28 |

45.41 |

Net Profit |

2.32 |

2.53 |

3.86 |

3.38 |

2.80 |

EPS |

0.75 |

0.81 |

1.24 |

1.09 |

0.90 |

The PE in FY07 will be close to 250. Market Cap/Sales ratio is 23 (Yes 23.)

Even Infosys has a MarketCap/Sales ratio of 10 and the company is growing QoQ.

Look at the Quarterly numbers this clearly shows that the company is not able to scale. But the market cap and PE suggest that the company should at least grow 100% QoQ for at least next 5 years.

Ansal PropertiesThis has a market cap of 3500Cr . Look at the Qtr numbers

Details below

|

Sep '05 |

Dec '05 |

Mar '06 |

Jun '06 |

Sep '06 |

Sales Turnover |

70.27 |

66.69 |

123 |

160 |

148 |

Net Profit |

7 |

8 |

11 |

28 |

22 |

EPS |

4 |

5 |

7 |

8 |

4 |

Same case this also has problems in scaling

You can paint a similar picture in other stocks also like Peninsula Land where the

market cap is 2400Cr and the sales is stagnent in 120 levels.

I am not against this kind of valuation if the companies are able to grow on a sustained basis. Now you can argue that we are all paying for future growth. That is all rubbish. How much future are you looking at one year , two year ??. Believe me that is not the case these are high gestation business in the range of 7-10 years. Which investor has the courage to buy at this rate for 10 years. You do not have the valuation cusion at these rates and you are not aware of the uncertain environment that many happen in next 10 years.

Look at Unitech valuation at 40,000Cr (Yes a market cap of fourty thousand cr) the market Cap to Sales ratio is 30 times. And most of its projects will start in 2007 and end in 2010-2015. For example a One Crore(10,383,943 sq feet) square feet residential apartment complex will start in 2006 End and will get completed in June 2013 (This is the projected date). Now who on earth will know that what is the state of that project or the real estate market in 2013. Or even the company is able to complete such a project. Believe me this is not the only project that the company is starting in 2007 (may be some 20-25 projects I could get from the company’s site).

I don’t know that is a viable size for inexperienced Indian real estate companies. So that being the case why you should value a company based on land holdings rather than the projected cash flow. Ultimately that is what matters for most of the investors.

What if the real estate bubble burst?Scary!!! This is one factor that no one is considering when they invest in real estate stocks right now. Yes the bubble will burst at some point of time. It has happened in more mature markets like America and Japan so that will definitely happen here also.

Now what makes matter worse in Indian scenario is the absence of an exit in the form of real estate trusts. And looking at the supply in the next 2-10 years I strongly feel that it will be difficult to get absorbed in to the market. (Infact if you look at just one company Unitech’s plan for next 10 years in terms of total salable residential plots ..i doubt even that itself will get absorbed)

The biggest problem is that 80% of all upcoming real estate projects are targeted at the residential market and with the prices of per square feet skyrocketing I feel that only from upper middle class will be able to afford such prices. If you want a reasonable flat in any of the metros or in small towns the average price is around 1500-2000Rs / Square feet.

Now if any one wants to buy a mid size flat of 1500sq feet the total cost will be some where around 35-40 lacks. And from where it comes from banks and the poor guy with an average monthly salary of 50,000 ( am talking of a reasonably salaried person) will be blocked for the next 15-20 years (As banks will take most of his monthly salary as EMI).

Now any problem with his employment even 5-10 years down the line can create a ripple effect in the property supply ( Don’t forget the tech meltdown in 2001)

ConclusionSo why to invest in a sector which has astonishing valuation and full of uncertainty going forward. More over real estate company management is not at all transparent in India.

The classic case is Unitech. The management never conveyed to their share holders about the land they hold or their future projects till their market cap reached 40,000. The scrip sky rocketed from 1 Rs to 500Rs (Adjusted for split and bonus) in just one year. And the management kept on buying the shares at low levels from the market. When it reached that kind of valuations they put a beautiful corporate presentation in their company site about the amount of land they hold and the projects expected start and end date. Only recently the media and the analysts got the full picture o their land bank and are trying to value based on that. So why you as a retail investor get in to these kind of a bubble with your hard earned money. Don’t forget the tech boom in 2000 when the companies were valued just based on the sector they were in. Visual soft which was at 10,000 is at 100 odd levels and many companies went burst. So make sure that you got trapped in to such a situation.

I am not too bearish as I painted above.I don’t want to paint a completely bearish picture as I know that there are many investors that are bullish on the real estate sector. What I said above are some of the concerns I do have about the sector. So if you ask me will the real estate stock can go up from here , sure it can but the risk will be high too. There can also be a possibility that the correction may not even come if India grows at the same rate and the percentage of high income group people keep on increasing.

A company which I am bullish on but don’t have any stakeThat’s an interesting caption. The company in focus is “Prime Textile” primarily a textile company from Tirupur. Even though I am bullish on the company based on the current valuation I do not have any stake in the company.

Lets look at the valuation details.

The Market cap for the company at the current price of 133 is just 60Cr. And more importantly its textile division is also doing good. The company is currently undergoing an expansion of its textile division. The topline from textile division is around 120Cr.

Now the company has a real estate division (Its not a subsidiary) . The company owns centrally located and commercially strategic landed properties at Tirupur. Out of the total holding of 28 acres, an extent of 17 acres is appurtenant to the Spinning Unit and the balance 11 acres is reserved for residential purposes.

The company has taken up construction of Luxury Residential Apartments and a Commercial Complex on a portion of land admeasuring about 6 acres.

Phase-1 construction of 3 blocks comprising 212 Residential apartments (overall saleable area: 268,903 square feet) is in full swing and likely to be ready for occupation by end-December 2006. Phase-2 construction of 5 blocks comprising 200 Residential apartments (overall saleable area: 312,142 square feet) will shortly be commenced.

The Commercial Complex will have overall saleable area: 273,506 square feet and aims at attracting biggest and best of the brands in retail trading.

If you attach a price tag of 2000Rs / square feet for the residential property the total value will come to around 120Cr And if you consider a rental rate of 25rs per square ft for commercial complex the rent per year will be some thing like 8Cr ( I don’t think they are planning to sell the commercial property, So that will be a recurring income).

The whole project started some 1 year back and at that time itself the company has stated that the first phase of residential apart will get completed in 2006-End and is right on track.

So a small company with small scale of real estate operations and more over the future price if not in the valuation.

Many respective people off late have taken some position in the stock . One among them is Manek Bhansali of Enam who has a 2.5% stake. He is known for his value buys in the Indian stock market. So may be at a Market cap of just 60 Cr this one is worth a look.

Disclaimer

As of now I do not have a stake in the company.

Research Report calendar

I am planning to update this space regularly as you will get an idea of what you can read here in future

- Company report on Geodesic Information Systems

A comprehensive report on the company covering its products and technology.

Also my own views on how i see these products do going forward and about its

competition

Progress : The report is in final stages and will be published shortly (next 1 or 2 days)

- Company report on Triveni Engineering

Progress : Initial stage . completion date (Dec - 2nd week)

- Company report on Micro Technologies

Geodesic Information: Emerging oppertunity in communication and mobile entertainment

Pre-AnalysisUsually I start a report with a “key investment highlights” section which tells the reader how undervalued at that time the company is. But I decided not to use that style in this report due to some reasons.

The main reason is that it does not make much sense to play around with past revenues of a core technology startup like Geodesic which make cutting edge products/technology for corporates and end users. The revenue and profits cannot be projected by any one in this stage as it can easily register astonishing swings in this stage. For example in first Qtr the Net profit of the company was 14Cr and in second Qtr the NP was 23Cr. Which is a 50% QoQ growth. Since some of its products had just released the profits going forward can swing considerably.

So it really makes no sense to calculate the PE , Market Cap/Sales and trying to come up with a valuation model for this. All I can say is at a market cap of 1000 odd cr the company looks promising. Also it makes more sense to value the company with respect to market cap which you will see in this discussion.

Why I like this companyWhen it comes to products company (whether it is a software company or a manufacturing company) there is a small thump rule you can apply to find out will the company will do well in the future.

“If a company is able to make a product which is 7 times good as an existing one and in 1/7th cost, there are very less chance that you will loose your money invested in the company”

And I think Geodesic is one such company

About Geodesic The company was started in 1999 by a group of technocrats. The company is widely recognized for its universal instant messaging system (www.mundu.com). The Mundu products successfully combine AIM, Google Talk, ICQ, MSN, Mundu and Yahoo with deep content collaboration across the Internet, wireless devices and platforms.

NB: Not many people know that Mundu is the third largest used instant messaging software in India. Indiatimes messaging services which is used by millions of Indians across the world is powered by Mundu. Totally there are 6million people using Mundu messaging systems every day either directly or through partner sites. And another heartening factor is that this figure is rising every day. (Most of the times people don’t know that they are using Mundu)

The following are the company's products

•Mundu web content aggregator

•Mundu universal Instant Messenger for the desktop

•Mundu universal Instant Messenger for Palm devices

•ADePT - self service Ad Management System

•Mundu universal Instant Messenger for Symbian Pocket PC, Blackberry and Linux

•Mundu Internet Radio for the Palm

•Mundu Speak - VoIP on Windows Mobile, Palm and Symbian across GPRS and Wi-Fi (a world first)

•Mundu IM referral (word-of-mouth marketing)

Recently the company was awarded the Inaugural Red Herring Small Cap 100 award.

In the following discussion we will briefly touch upon most of the company's products (some of them very recently launched) so that you will get an idea of how the company will do in future.

A small note on the managementThis is one big strong points in Geodesic (May be this team of strong management is one reason that foreign investors got so much attracted to this stock from very early stages)

Apart from eminent technocrats like Kiran Kulkarni and Pankaj Kumar other notable figures in the management are high profile Mahesh Murthy (Director) who is the man behind many successful startups in US. He now owns a venture capital fund called passion fund and is one of the early stage investors in Geodesic. (He is also the one behind the search marketing firm Pinstorm). Another notable figure as an independent director is Vinod Sethi, an expert investment banking expert who was behind the success of Morgan Stanly Growth fund in India.

The presence of such people in management is a comfortable factor for an investor especially when he is investing in a startup technology company where the rate of risk and returns are quite high.

Mundu Radio – A hundred thousand radio stations on your mobile

This is one of the most exiting applications which targets Entertainment – on the – Move space. The space is worth several billion dollars worth worldwide and there are lot of players which targets this segment with lot of products.

Some of them are your IPods, FM Radio’s, Internet radio’s like world space etc. But in most of the cases you need to carry extra equipment and have to pay a subscription fees for some other. How often you wondered why is it not possible to listen the radio station you liked on your mobile phone. (Some mobile phones come with inbuilt FM radio, but it will only play stations in your locality).

That’s the space Mundu radio is trying to address when it announced the beta version of the product this September. It allows you to access close to one lack (yes 1, 00,000) radio stations having both international and local content from any part of the world in to their mobile phones.

Mundu Radio supports streaming at 24 Kbps and 32 Kbps which is superior in sound quality experience than the currently offered Mp3 streaming on mobile phones. It is compatible with popular handsets based on Symbian, Windows Mobile and Palm OS platforms.

Moreover the users can personalize their play list and manage their profiles using easy to use interface provided as part of the software. In a mature market like US, internet radio is the primary mode of entertainment. People listen to radio while they travel and usually one fifth of the total population listen to internet radio for 5-8 hours a day.

The facility of hearing internet radio on mobile phones eliminate the need to carry additional devices and a superior sound quality makes it one of the most exiting applications ever made for mobile phones.

Now how big is this market? IDC forecasts that US wireless services will have over 50million users and will generate more than a couple of billion dollars in revenue by 2010. And the interesting part is that this segment appeared only in late 2005 and Mundu Radio is one of the promising applications that target this segment.

Mundu Messenger – Real time collaboration between trusted parties.Understanding the business model of various IM businesses can be a difficult task but most interesting fact is that most of the top IM providers which target the mass market do not generate enough revenues. This is because the people are reluctant to pay for these IM services that they use. (Just imagine how many people will use yahoo or msn if they start charging for that :-) ).

But Mundu IM messenger is profitable and has a very sound business model which revolves around real time collaboration between trusted parties. Which most of the major IM players target the C2C (consumer to consumer) market, Mundu IM targets the B2C (Business to Consumer) or C2C (in a business platform). So in this model the provider of IM services has to pay for using the Mundu IM and there are some compelling reasons why they go for it.

Now let us see what forces the business to use a costly Mundu service when there are free alternative.

The one thing that holds back IM from being adopted as a standard is the lack of interoperability between different instant messenger software products. It is exactly this vacuum that Geodesic hopes to fill in with its product. Currently, Mundu has a unique advantage over other competing brands as it is a messenger that is compatible with all the industry leaders like AOL, MSN, ICQ and Yahoo. With the core technology in place, Geodesic hopes to provide in Mundu a kind of brand that would fit the needs of businesses of all sizes.

When I say interoperability it is very simple, using the Mundu platform you can collaborate with any one using any of the messengers be it Yahoo, MSN or google.

The potential target segments that Geodesic is looking at include call centers, finance and IT organizations, providing an instant messaging network for business-to-employee and business-to-customer. With its ability to manage communications over multiple channels, i.e. web text chat, integration with messaging networks and wireless devices such as PDAs and mobile phones, Geodesic could very well turn this product into a goldmine.

Now this feature of Mundu to interoperate with other messengers using web text chat is a very useful feature for portal owners. They can retain their visitors for more time with out allowing them to leave their portal for communication. Now this can lead to more communication to the prospective customer and more client conversion.

Another segment which Mundu IM creates is Instant E commerce.

The biggest block for ecommerce in India and across the world today is the lack of personalization that the users demand. This is one space which IM can address. If you go to a site and like a product, you would obviously want to know more about it. And what better way to explain to a customer his queries than an instant messenger. And more over if you can do that without leaving the site that leads to better conversion rates.

The product would be a great hit when deployed in banking applications. A bank could have an instant messenger operational and have queries answered instantly, cutting down on the time spent by customers over phone calls and at the bank itself. For banks and financial institutions worried about security issues, the Mundu IM offers SSL-based 128-bit encryption for authentication and messaging.

Now I mentioned here about security when using IM. Most of the organizations will not allow the use of popular IM in its own network. This is because the IM’s would open a security threat and is a gateway to most of the viruses and worms to get in to the network.

And most importantly you cannot restrict the users who try to contact to the employees if you use general instant messaging software like Yahoo or MSN. But Mundu helps the organization by allowing the organization employees to interact with only their customers in a secured way (usually from their own website were the customer had logged in)

What more?Well there are lot of other interesting and cutting edge software that this company recently introduced. One is Mundu Talk which allows mobile users to make unlimited VoIP calls to any other mobile phone which has Mundu platform.

And there is another new produce called Engage spider which they launched recently which is a relationship management software. (This is mainly used in financial institutions).

But I think I had talked a lot about this company and will post more later. It is enough for now :-).

ValuationAs I mentioned earlier it really does not make any sense to assume the valuation of this stock based on historical PE and is not easy to calculate the future earnings. One simple estimate I can say is that if the product is able to capture at least 15-20% of market share in its respective fields, We are talking about billions of dollars in revenues. Right now it I just a 200m company in valuation. To me there is an opportunity here as I do see lot of value in lot of its products.

Thus far, the only missing link in the strategy of Geodesic has been on the branding front. The technology is great and there is no doubt that the company has with it a killer app yet there are not too many who know that Geodesic is the “brain” behind the Indiatimes instant messaging success. The company has now realised this and plans to get more aggressive on the brand-building front. Also there are lots of key appointments last Qtr for marketing its products.

DisclaimerAuthor is a software technical consultant based out of Hyderabad. At the time of writing this article he and his family members do have investments in the stock mentioned above. The author, his firm or any of his dependent family members may make purchases or sale of the securities mentioned in the report while the report is in circulation.