Triveni Engineering: A value buy

IntroductionWhen the sensex is at 14,000 normally it should be very difficult to invest in the market if some one follows the conventional wisdom. But this time it is very different. It seems even now many stocks can be found in the market where there is valuation comfort and in some cases undervaluation. I guess mainly it is due to the fact that in the recent sensex rise only a handful of stocks participated and the pocket of over valuation is limited to very few stocks and sectors. For example the real estate and construction sector which is the favorite sector and where you can find most over valuation.

You can access my article on the over valuation of real estate sector here

"Real Estate Reality Check"

One such stock which is in a neglected sector and which is one of the major player in its sector is Triveni Engineering. This trades at a price of 55Rs and a Market Cap of 1400Cr.

You can read the complete analysis of this stock and the sector given below.

Key Investment Highlights

Sugar Business

•Second largest producers of Sugar in India with a crushing capacity of 40,500 TCD per year (2005-06)

•The company is undergoing a massive expansion plan where the capacity will be increased to 61,000 TCD by Feb 07.

•The company will also commission a 160 KLPD ethanol manufacturing plant by March07

•The Co-Gen capacity will be increased from the current 22MW to 68MW by 2007 which will also create 2,00,000 carbon credits

Steam Turbine Business (TBG – Turbine Business Group)

•One of the largest manufacturers of 1-12 MW steam turbines in the world with a 68% market share in India’s high and low pressure turbines up to 18 MW.

•Manufacturing capacity of 650MW in turbines which is being expanded to 1100MW in 2006-07 (Fourth Qtr)

•More than 1800 turbine installations.

•Order book of 512Cr as of Sep2006 for Turbine Business Group (TBG)

•Turbine Business Group's revenues is now close to 47% of the group's total revenues up from 22% just two Qtr ago making it a second line of business apart from sugar.

•Exponential growth seen in turbine business with industrial growth.

•The company is also getting in to higher MW turbine business (18-45MW) whose market is almost 50% bigger than the up to 18MW segment.

•TBG expects a sales of more than 500Cr in FY07 (230Cr already done by half year with a 45% QoQ growth)

•The company is now focusing on exports to Europe and Asia to drive up sales and margins.

Gear Business (GBG – Gear Business Group)

•Market leader in high speed gears and gearboxes up to 70MW capacity and 50,000 rpm

•Order book of close to 40Cr as of Sep2006 and expects revenue of 80Cr this year.

•More than 4000 high speed gear box installations in the country.

•This is the first company in India to successfully conduct full speed test on 54 MW gas turbine load gearbox.

Others

•The company has already decided to spin off the TBG and GBG to a separate company which will create shareholder value.

•This is one of very few companies that can greatly leverage their stock value for growth as the management holds close to 70% stake and public holding is just under 8%.

•Current market cap of 1400Cr does not even reflect the valuation of sugar business after enhanced capacity.

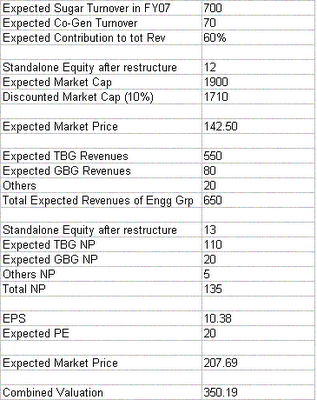

•In my calculation after the spin-off the combined value of business should be around 350 Rs ( Valuation details given later in discussion)

Overview

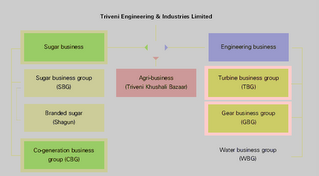

First of all Triveni is not just a sugar company (popular perception is that). Triveni is one of the leading companies engaged in the manufacture of sugar and engineered-to-order

mechanical equipment, such as steam turbines, high speed gears and water and waste water treatment equipment. The company is the second largest sugar manufacturer in India and the market leader in the engineering businesses comprising steam turbines, high speed gears, gearboxes, and water treatment solutions.

Besides this the company also diversified in to futuristic businesses like water and waste-water treatment and rural retail.

The business of the company is best described in the figure below.

The recent downturn in sugar prices has resulted in the downturn of Triveni’s stock price which after touching an all time high of close to 180 is hovering in the range of 55Rs. This is more or less because Triveni is more considered as a Sugar company but the reality is that only 55% of the revenues come from sugar. Also even in sugar business the company is expanding its capacity by almost 50% compared to last year.

Because of all these factors I think this is a good stock if you are willing to hold it for some time. I think Triveni is a good contrarian buy at this level.

To understand why Triveni is a good buy at these levels it is very important to know what are the business the company operates. The highlights of each of these divisions are discussed below.

The Sugar Business Group (SBG)

The SBG comprises of the sugar division and the Co-Generation division. My discussion will not cover the outlook for sugar as I am not an expert in commodity cycle. But from my understanding the sugar prices is directly proportional to crude price internationally as when crude rises more sugar cane will get converted to Ethanol. (Ok let’s leave that part).

The company currently has a capacity of 41,000TCD and is being expanded to 61,000 TCD. All these expansion will fall under the UP sugar mill policy where the company will be able to get special incentives in the form of capital subsidy, reimbursement of sugar transportation costs, refund of cane society commission from the government. (Refer UP Sugar Policy 2005-06 for more details)

Apart from the sugar business the company has a Co-Generation business which supplies power to the grid and addresses the captive power and steam requirements of the sugar factory. The Co-Gen division recorded revenue of 60Cr in 2005-06. The company is also

expanding the capacity of Co-Gen plants which will fetch additional revenues in future. Apart from a ready market like a power starved Utter Pradesh the company will also be eligible under the Clean Development Mechanism (CDM), entitling the company to carbon credits, by selling certified emission reductions (CERs). The expected number of carbon credits which is expected after full expansion is around 2, 00,000 numbers. (The company should get approval by Dec-2006)

The Ethanol story

By Feb-07 the company will also setup a 160 kilolitres per day (KLPD) distillery for the production of rectified spirit, Extra Neutral Alcohol (ENA), absolute alcohol (fuel ethanol) and industrial alcohol.

Now understanding the whole Ethanol story is very important so that you understand the full potential of Triveni going forward. Infact this is same for all sugar companies in India which has Ethanol manufacturing capacity.

Now first let us look at the global scenario. In Brazil and USA Ethanol is produced from sugar cane and maze. So when the prices of crude increases there is an increased temptation to convert more sugarcane to Ethanol thus pushing up Sugar prices (since most of the sugar cane is converted to ethanol). So for sugar companies in Brazil and US it is an alternative product from the same raw material.

But in India situation is different. In India Ethanol is produced from molasses a sugar by-product. So in India the production of ethanol will complement the fortunes of the sugar industry. Coupled with this if government makes mandatory 5% ethanol blend on an all India basis it is just another bonanza for the sugar industry. So the companies with this capacity will definitely benefit and triveni is one among that.

The Turbine Business Group (TBG)

Initially the TBG was created as a backward integration of the company’s sugar business but has exceeded all expectations and grown in to an altogether parallel business. Triveni is one of the largest manufacturers of 1-12 MW steam turbines in the world with a 68% market share in India’s high and low pressure turbines upto 18 MW.

This is one group which is growing exponentially on a YoY and a QoQ basis.

So as shown in the charts the TBG group now contributes 47% of the revenues and has the highest visibility in terms of order book. The company is almost doubling the TBG capacity to meet the growing demand.

Another lucrative area the group focuses is the after sales service. The spare business generally generates incremental revenues only after 2-3 years of turbine installation. The recent ramp up in turbine sales will generate substantial incremental spares business in the next few years. The company has 13 service centers across India offering emergency support, routine repair service and spare parts to customers. Because of their pan India presence the company will able to attend any service calls with in 24 hrs which is very important. I expect this area will contribute close to 5-6% of sales in next 2 years.

The company is also getting in to higher MW turbine business (18-45MW) whose market is almost 50% bigger than the up to 18MW segment. TBG expects a sales of more than 500Cr in FY07 (230Cr already done by half year with a 45% QoQ growth).The company is now focusing on exports to Europe and Asia to drive up sales and margins.

The Gear Business Group (GBG)

The company started to manufacture gears and gear boxes to the turbine business group. Since then this group emerged as a stand alone business supplying high speed gears and gear boxes to Triveni TBG and also to other prominent OEM’s like Siemens and BHEL.

Another interesting fact is that these OEM’s which are the customers of GBG completes with Triveni’s TBG for the manufacture of steam turbines.

This is another business which have lot of visibility going forward

Sales at this division are expected to be in the range of 80cr this year.

Recently company has successfully conducted full speed test on 54 MW gas turbine load gearbox, at its modern facility in Mysore. It is the highest power gearbox manufactured and tested successfully by any Indian engineering company. It will serve as a replacement to a European Gearbox. This marked the company’s entry in to high MW gear box market.

Other Emerging Business

Apart from these main business above the company has presence in water and waste water treatment solutions and rural retail. Both of these business are currently small in nature but has high potential going forward.

In rural retail the company has a presence with Triveni Kushali Bazaar which will have close to 90 stores by next year. This is a business which has great potential going forward. In 2005-06 the division has a top line of close to 16Cr and is growing exponentially.

De merging to create share holder value

The board of directors is already considering a proposal to de merge the Engineering business in to a separate entity to create share holder value. This will allow the investors to value each business in a separate way and in the process create wealth for shareholders.

I have created a small valuation matrix which will allow you to calculate the valuation of each of these businesses after the de merger.

NB: This is very premature valuation and can drastically change based on the management decision.

Also if the sugar cycle turns there can be more valuation to the sugar business. And the revenue from 160KLPD Ethanol division and the revenue from possible carbon credits are not considered for calculation. This can further enhance the valuation of sugar business.

That value of 350+ is a huge upside from the current levels. But this is subjected to lots of factors.

Risks

There is risk in investing at the current time. The factor is that sugar is a neglected sector now and Triveni is now perceived more as a sugar company. So any down turn in the sugar prices can adversely affect the company’s valuation.

Conclusion

Even though there are some risks in investing in the company at the current levels, I personally feel that it is worth taking a risk especially if you are a long term investor.

Read about other value buys

Geodesic Information: Emerging oppertunity in communication and mobile entertainment

Aftek Limited : A stock for the future

Disclaimer

Author is a software technical consultant based out of Hyderabad. At the time of writing this article he and his family members do have investments in the stock mentioned above. The author, his firm or any of his dependent family members may make purchases or sale of the securities mentioned in the report while the report is in circulation.

This report has been prepared solely for information purposes and the information contained herein may not be deemed to be an investment advice. Such information is impersonal and not tailored to the investment needs of any specific person. The information contained herein is not a complete analysis of every material fact representing any company, industry or security. The views expressed may change. While the information contained herein has been obtained from sources believed to

be reliable, no responsibility (or liability) is accepted for the accuracy of its contents. Investors are advised to satisfy themselves before making any investments and should consult with and rely upon their own advisors whether and how to use such information in making any investment decision. Neither the author nor his firm accepts any liability arising out of use of the above information/ article.

18 Comments:

Invester_F2,

You are doing a great service to the investing retail community by such detailed analysis... Having profited in good measure by your calls on Amara Raja (when it was sub 100), I eagerly look forward to such analyses from you.... May God shower his choicest blessings on yourself & family...

Best Regards,

-feltra

Hi Sajith ,

Very clear and illuminating analysis of Triveni. It is indeed a value buy worth adding to ones portfolio. I would like your opinion on Virinchi Technologies ( another product company which is a leader in micro lending industry software ).

Regards,

objectivist

Thats an interesting company i had a look at it sometime back. Micro lending industry has a great future but i am not able to tell you how much potential can be there for the software for the same. But company is interesting story with small small products. But with a market cap of just close to some 40Cr it is worth a look. But these companies will make a move only if the market starts focussing on the software sector.

Hi i_fii, have been reading your views on aftek for quite some time on MC board. Have been holding it for log. Anyways, Triveni also is on my radar. Wanted to know, whether any equity dilution is expected for any of these expansions? 'Coz else, all looks rosy. Some board meetings in May-06 also were related to FCCB/QIP/FCCB et for Rs 800 Cr. ....

For Triveni till now there is no equity dilution. The best part for triveni unlike other sugar conpanies is that most of their expansion is funded by IPO money and the rest by debt. This gives Triveni an edge over its peers like Bajaj Hind and Balrampur chini which requires substabtial dilution to fund their expansion.

Another comforting factor is high promoter holding for Triveni (70%) unlike its peers like Bajaj Hind (37%) and Balrampur(31%). This is because even if they want to fund the expansion they can dilute the promoter holding without much dilution in overall equity. This is not possible for other sugar majors due to low promoter holding. Which promts them to go for FCCB/GDR etc.

Really I should congradulate on your very good work for a lay investor like me.After your write up it is heartening to know many things that are hidden which you have brought it to lime light.Keep up your good work.

SUMAHEMA

Hi Sajith ,

Triveni has registered a total NP of 85 cr for 9MFY07 so far. Perhaps the numbers in your graphic need to be revisited since you expected a 135 cr profit for the standalone engineering division.

Regards,

objectivist

Hi objectivist,

Yes the total turnover in the engineering division will short fall of around 10Cr (since it is just 10% thats the reason i didnt try to recalculate)

The short fall is because of the TBG revenues this Qtr. In 9 months the TBG posted revenues of close to 72Cr. If i expect a revenue of close to 28cr last Qtr, the total revenue of TBG group will be 100Cr ( I calculated for 110Cr for TBG group)

The gear business is all set to achieve the target revenue of 20Cr. In three months the revenues is already 15Cr.

The rest should come from other division of water traetment. If that division gives 5Cr for the entire year ( which is more likely) then the total revenues will be close to 125Cr which is just 10Cr short of out target 135Cr :-)

Hi

Really a wonder full wrote up on Triveni engg.Is there any need for your projection to be revised after their poor sugar performance.

Reply at your leisure

SUDHA BADRINATH

Hi Sudha,

Not really just based on the sugar performance. You can read the comments that i give to objectivist for the TBG revenue shortfall. Its just 10Cr ..so my projected 135Cr for the engineering div can be 125Cr at the end of 4th Qtr or may be slightly more.

Now coming to sugar revenues. I am bullish on this revenue segment of the company even after a weak sugar prices. This is mainly because of the effect of expansion kicking in by March this year. Also the benifits of UP sugar policy will start kicking in from next Qtr and that will improve the bottomline.

The the cogen capacities coming up by next Qtr and also the Carbon Credits that will be generated by them. I have not factored those aspects in to my calculation. It is expected that almost 1.5 lach carbon credits will be up for sale by March07 ( It is in the final stages of approvement).

So all these things will act as a cusion against the falling sugar prices.

So keep your investements in this stock it will surely will get rerated by the time of demerger.

I am planning to wire a results analysis of the stocks i have mentioned here in a short time. So you can read more details from there.

HI

Thanks a lot for your reply.In fact Only after posting my message I saw your reply to the same line of thoughts raised by another person which You have replied.All your work needs lot of appreciation all investor who has the long term out look,patience and faith in the stocks mentioned by you will be rewarded.Aftek has started its upward journey from the level of Rs.60.Triveni should follow soon.

I once again let me share my deep sense of congradulations for your value buy recomedations to small investors like me and hope some more value pick should be seen by you which is in the pipeline.

SUDHA

Sir,

Eagarly awaiting your post results analysis of triveni engg as promised by you in your reply to one.

Is the often talked demerger is over and if so when is the record date for that.

Just to add, it was really a nice analysis by you on triveni.I want to share my appreciation and compliment the same in this regard.

Kannan Srinivas

Yes i am working on that analysis..not just on Triveni..but on the whole sugar sector. Which i feel is available at reasonable prices. You can shortly see that analysis here which covers top sugar companies like

BajajHindustan , Triveni and smaller niche companies like Sakthi Sugar and Renuka sugars. The report is in its initil stages .. ( The problem is i am not getting enough time for that :-) )

Sir,

Thanks for your prompt reply.I too agree with your view that these sugar stocks are at very reasonable valuation after the carnage.For a new entrant in this sector downside is limited to say another 10 percent.

Eagarly awaiting more on Triveni since its dependece on sugar is far less than many others.Your fantastics compilation of the report speaks volumes about the scope of capital appreciation for beleivers of sector say in two years time

Thanks once again

Kannan srinivas

You can refer to my new article to sugar sector

Sir,

Triveni has come out with their qtr results.

Can I request u to give your thoughts post this qtr results of TRIVENI.

Thanks in advance

Kannan srinvas

Hi Sajith ,

The UP govt has trashed all the incentives and is likely to come out with a new policy. Your view on this new development and on the weak quartely results of Triveni. I couldnt find the segmentwise result for this quarter but it seems sugar segment posted a substantial loss to drag down the net profit.

objectivist

The UP govt scrapping the policy was unfortunate for UP based sugar stocks..Infact most of the UP based sugar stocks had made substantial investments because of that [infact it was a very benifitial policy for sugar companies]

I am waiting to see the new UP sugar policy..if it scraps all benifits of the earlier policy then it would be time to see sugar stocks atleast for the medium term.

This is a big problem if the govt's dont uphold previous govt policies

Post a Comment

<< Home